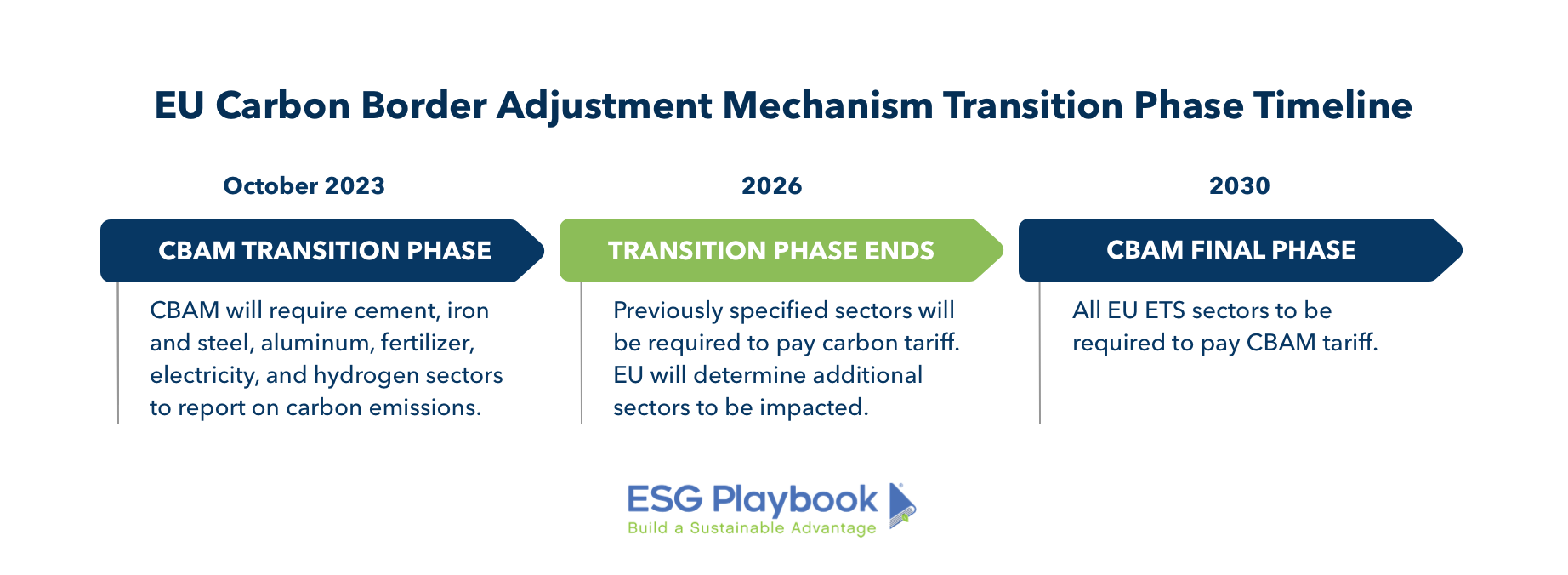

On August 17, 2023, the European Commission revealed its decision to implement reporting regulations targeting importers involved in the Carbon Border Adjustment Mechanism (CBAM) during a transitional phasing in of the new tariff. Throughout this transitional phase, set to commence on October 1, 2023 and extend through 2025, traders will be obligated to provide reports detailing the emissions associated with their imported goods that fall under the mechanism’s purview. However, during this period, they will not be subjected to any tax payments.

CBAM, introduced earlier this year by the EU, aims to establish an equitable cost for the carbon emissions generated during the manufacturing of carbon-intensive products that enter the EU market. This initiative also serves to promote more environmentally friendly industrial practices in non-EU nations. The incremental implementation of CBAM is synchronized with the gradual reduction of free allowances distributed within the EU Emissions Trading System (ETS), thereby bolstering the drive towards decarbonizing the EU’s industrial sector.

By verifying the payment made for the inherent carbon emissions arising from the manufacturing of specific goods imported into the EU, CBAM will guarantee uniformity between the carbon pricing of imports and that of domestically produced items. This alignment safeguards the integrity of the EU’s climate goals. Notably, CBAM’s design adheres to the principles laid out by the World Trade Organization (WTO).

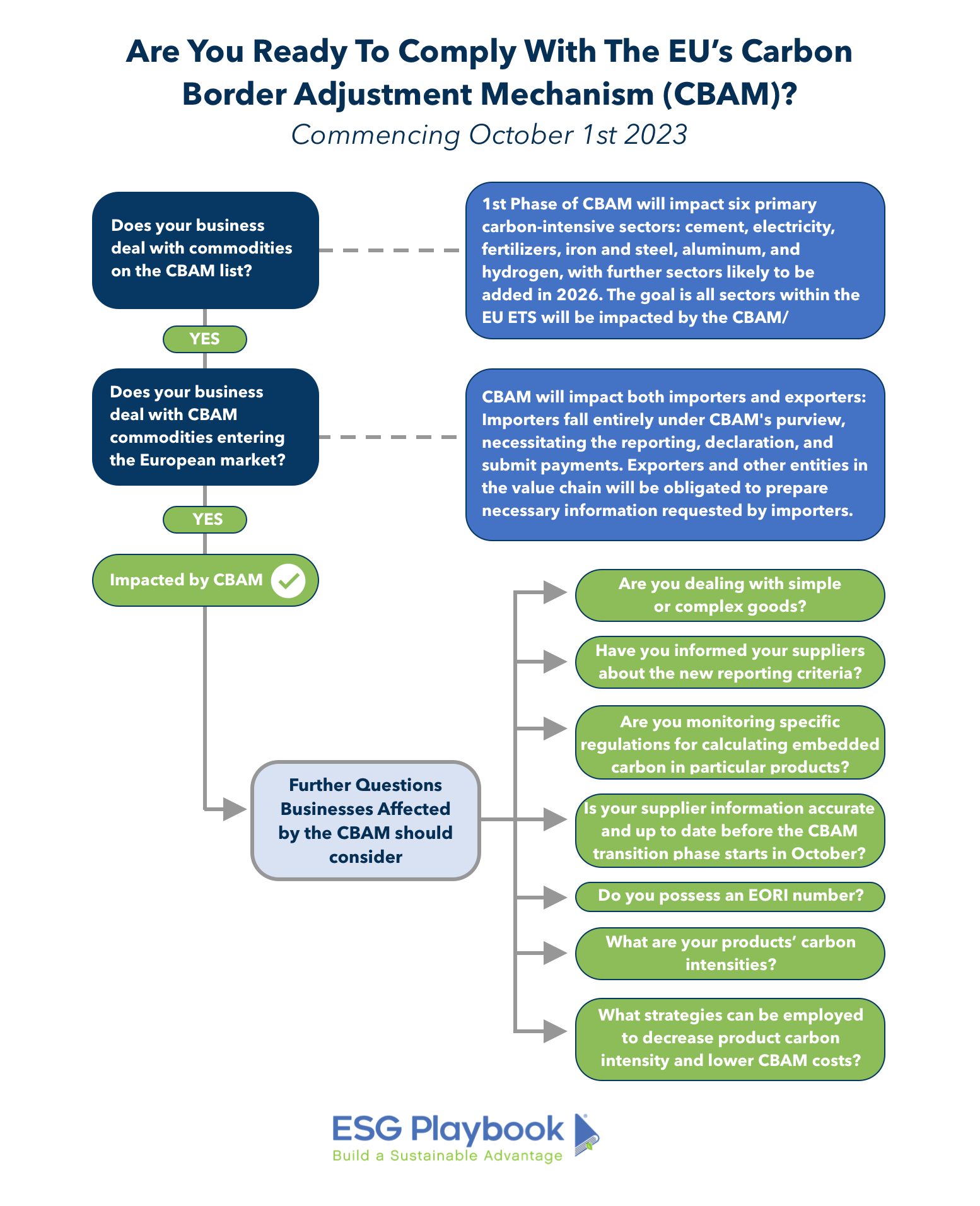

In its initial phase, CBAM will be implemented for imports of specific goods and chosen raw materials characterized by carbon-intensive production processes and a high susceptibility to carbon leakage. These items include cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen. However, all EU ETS sectors will eventually be included. The EU Commission has released comprehensive guidelines to support importers and producers from non-EU nations in the smooth implementation of these new regulations.

Is your company fully equipped to adhere to these requirements? Should you require assistance in getting ready for CBAM or any other ESG-related endeavors, the ESG Playbook team is readily available to provide support. Don’t hesitate to schedule a call with one of our team members today to gain further insights.