On March 6th, the U.S. Securities and Exchange Commission (SEC) gave the green light to its much-anticipated climate-related disclosures rule. While the finalized rule represents a scaled-back version of the initial proposal, it marks the SEC’s most elaborate disclosure initiative in decades, underscoring the significance investors place on climate-related data.

So, what are the crucial components and insights to glean from this regulation? How exactly do they differ from the initial proposal? And what is the timeline for implementation? Here’s everything you need to know.

Key Difference Between The Initial Proposal and the SEC’s Climate Disclosure Rule

- Most notably, Scope 3 emissions disclosures have been omitted, and the disclosure requirements for Scope 1 and 2 emissions have been significantly relaxed.

- The requirement to assess financial statement impacts line by line is eliminated. Instead, disclosure of amounts directly reflected in the financial statements is mandated when such aggregate amounts surpass 1 percent of pretax income or total shareholders’ equity, subject to a de minimis threshold.

- Smaller reporting companies (SRCs), emerging growth companies (EGCs), and non-accelerated filers are exempted from the obligation to furnish GHG emission disclosures and related attestation. The initial suggestion aimed to mandate all publicly traded corporations to disclose their direct emissions.

- The final rules no longer include a requirement for companies to disclose the climate expertise of their board of directors’ members.

- The rule mandates companies to disclose pollution from specific greenhouse gasses, but solely if they deem the emissions “material” or of substantial importance to their investors. This represents another significant departure from the initial proposal.

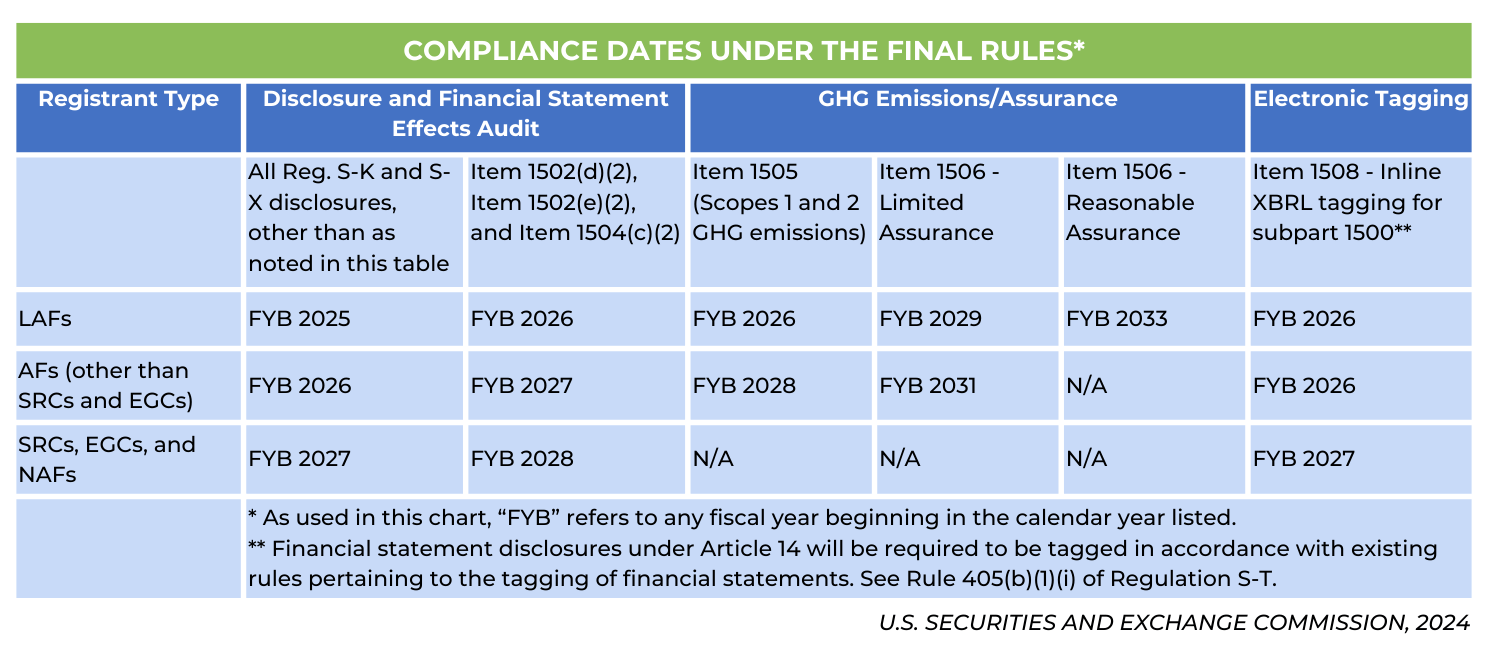

- The adoption timeline has been extended, allowing large accelerated filers almost (1) two years to furnish most disclosures, (2) three years for GHG emission information and specific other disclosures, and (3) six years to acquire limited assurance over GHG emissions.

Other Important Key Takeaways From the Final Disclosures

Crucial takeaways from the final disclosures include the requirement that impacted companies must reveal several key details, including significant climate-related risks, actions taken to address these risks, insights into the board of directors’ supervision of climate-related risks, and management’s involvement in managing such risks. Additionally, they must disclose any relevant climate-related targets or goals affecting their business, operations, or financial standing.

To aid investors in evaluating specific climate-related risks, the finalized rules mandate the phased disclosure of Scope 1 and/or Scope 2 greenhouse gas (GHG) emissions by certain larger registrants when those emissions are deemed material. This also includes the submission of an attestation report covering the required disclosure of such company’s Scope 1 and/or Scope 2 emissions, also on a phased-in basis.

Additionally, disclosure of the financial statement impacts of severe weather events and other natural conditions, such as costs and losses, is required. The finalized rules incorporate a phased compliance period for all registrants, where the compliance date is contingent upon the registrant’s filer status and the nature of the disclosure content.

Companies Impacted and Implementation Timeline

All domestic and foreign registrants, excluding asset-backed issuers, are obligated to adhere to the disclosure requirements. However, SRCs, EGCs, and non-accelerated filers are exempt from Scope 1 and Scope 2 GHG emission disclosure requirements but are required to provide all other disclosures. Furthermore, disclosures may be provided prospectively upon adoption.

Approved by a 3–2 partisan vote, the rules will take effect 60 days after their publication date in the Federal Register.

Broader Impacts

The increasing prevalence of climate-related disclosures mirrors a growing awareness among investors, companies, and markets alike. It’s now widely recognized that climate-related risks have the potential to influence not only a company’s immediate business operations but also its long-term financial performance and positioning.

Due to the growing importance of strong climate-related data, one primary objective of the new rules is to establish standardized climate disclosures. Presently, numerous large companies publicly disclose emissions information and climate risks, but they employ varied reporting methodologies, formats, and platforms. The finalized rules establish a structured reporting framework for such emissions data and climate risk information.

However, uncertainty remains regarding whether reports created in accordance with the SEC’s Final Rules will be acknowledged as meeting European sustainability reporting standards, potentially eliminating the need for separate reports under both the Final Rules and CSRD. Similarly, the obligation for registrants to prepare distinct reports under the Final Rules and California’s mandatory reporting framework remains unclear.

To receive guidance in addressing these complex disclosure challenges, the ESG Playbook team is readily accessible to provide assistance. Schedule a demo with us to discover how our team can support you.