The EU’s Omnibus Legislation: What Businesses Need to Know

The European Union is accelerating its sustainability agenda—but not without challenges for businesses. As part of the European Green Deal, new regulations are reshaping corporate ESG reporting. While these measures aim to simplify compliance and reduce administrative burdens, they also introduce new complexities that companies must navigate.

The Omnibus Legislation, a key initiative under the European Commission’s 2025 Work Program, is designed to streamline sustainability reporting, align regulatory frameworks, and ease compliance pressure on companies of all sizes.

📌 What is the Omnibus Legislation?

The 2025 EU Simplification Package, which was just released yesterday, is part of a broader initiative to cut red tape, making sustainability compliance more practical and efficient.

Key Objectives of the Omnibus Legislation:

- Reduce redundant ESG reporting requirements by integrating overlapping data requests.

- Introduce tailored regulations for small mid-caps—a new category between SMEs and large entities.

- Target a 25% reduction in administrative burdens for companies, with SMEs potentially seeing up to 35% fewer reporting obligations.

While these changes aim to simplify compliance, questions remain about their effectiveness. Will the reductions be meaningful, or will businesses still struggle with complex sustainability disclosures?

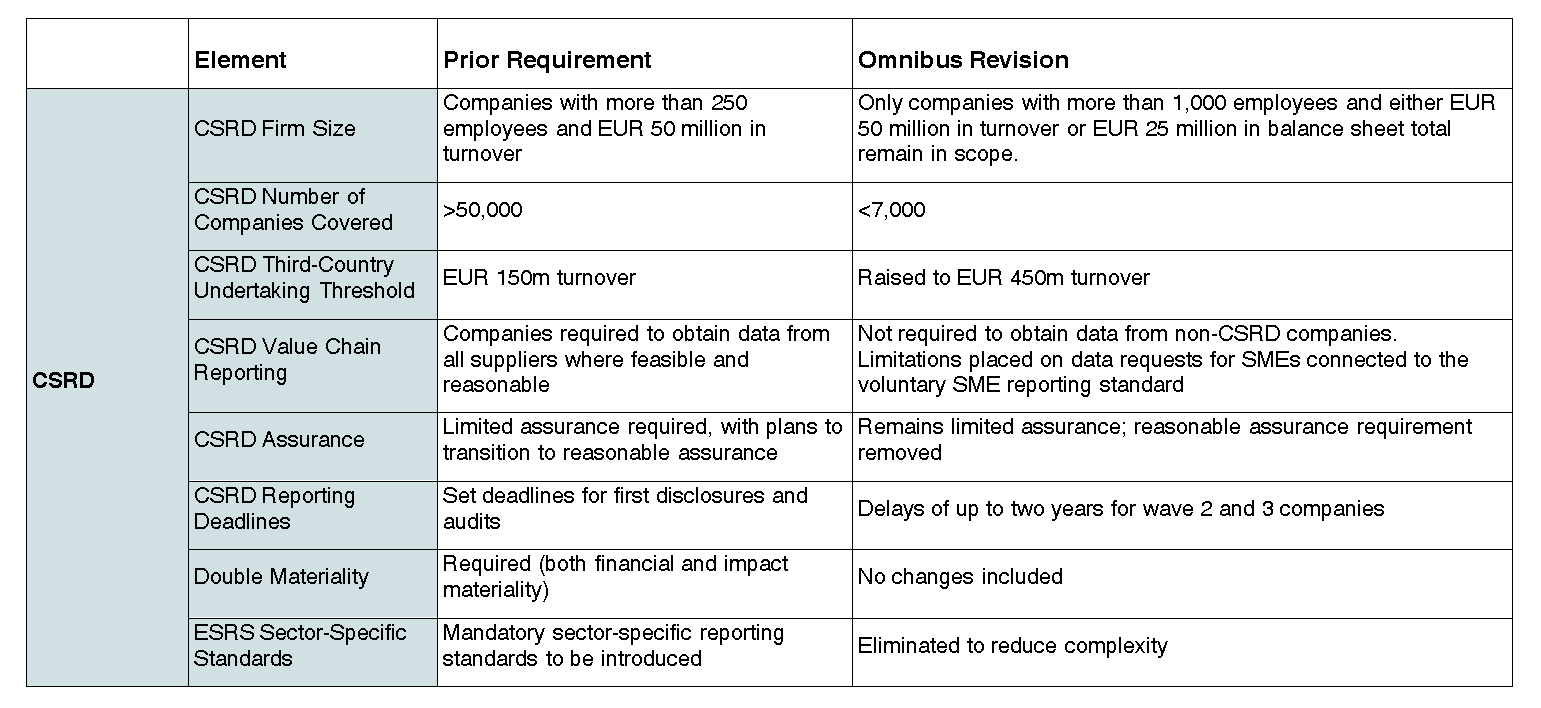

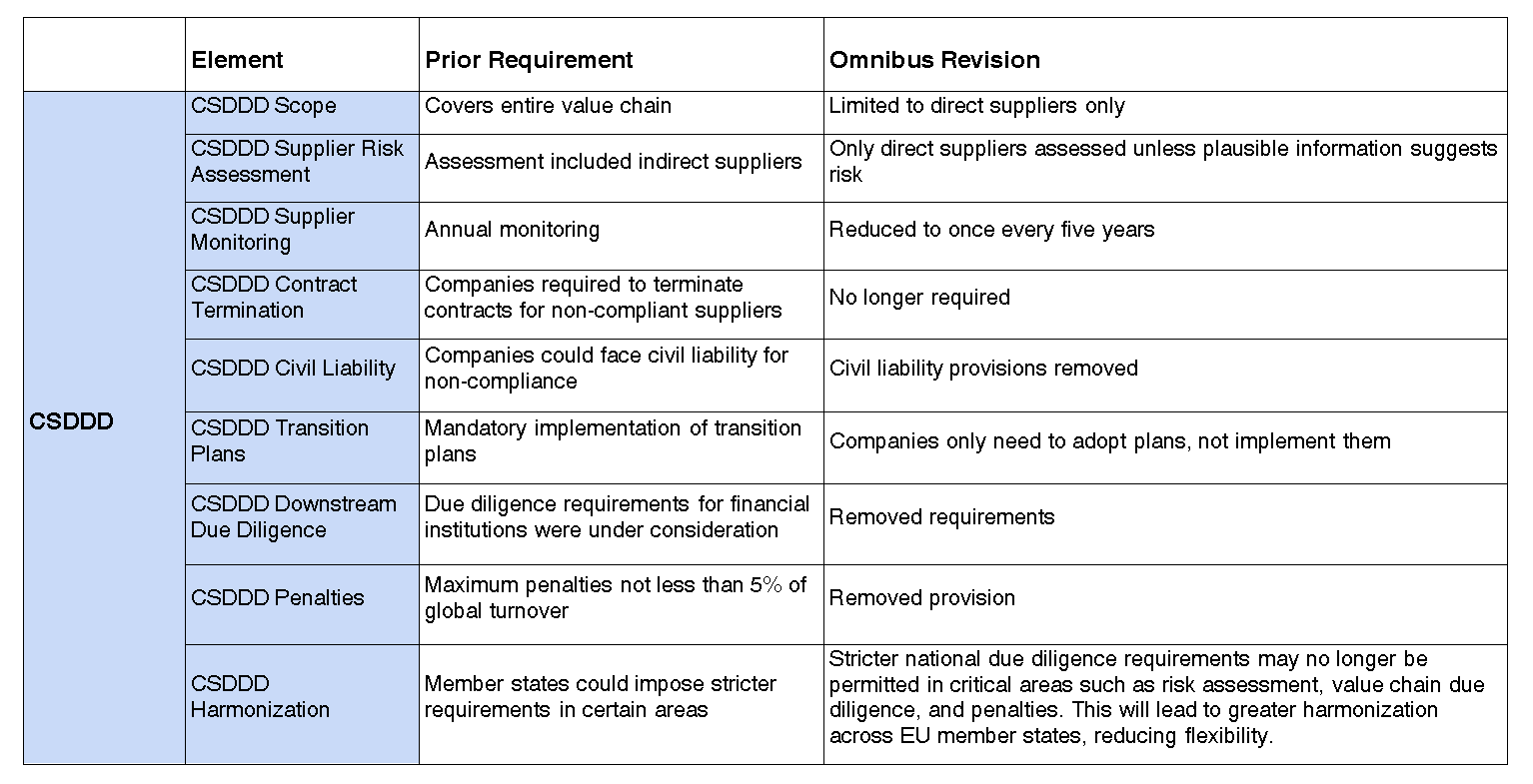

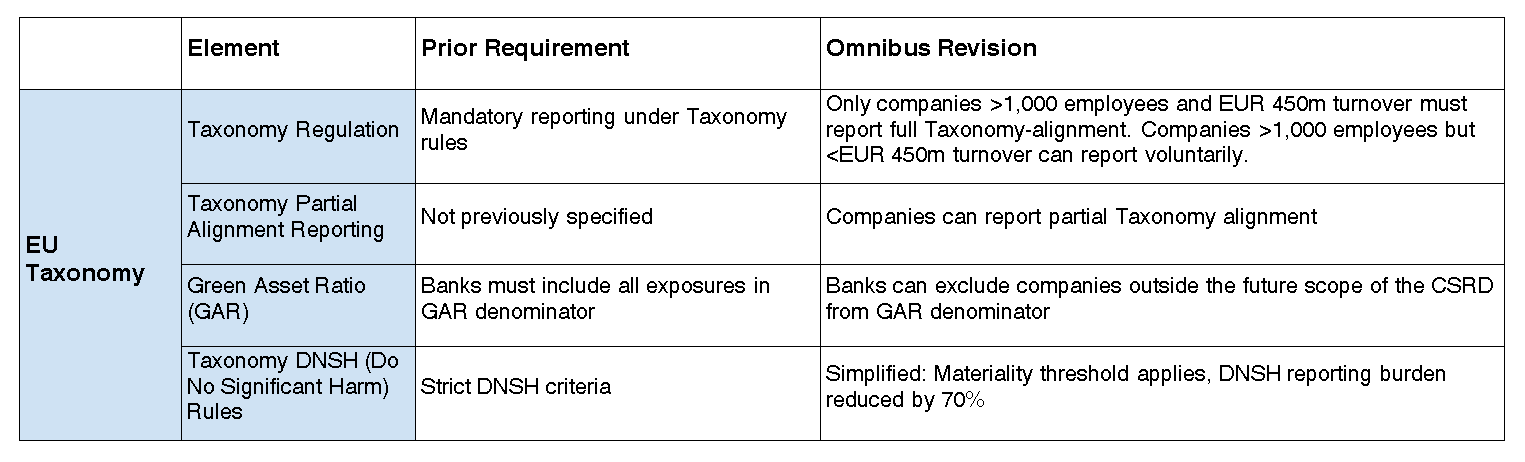

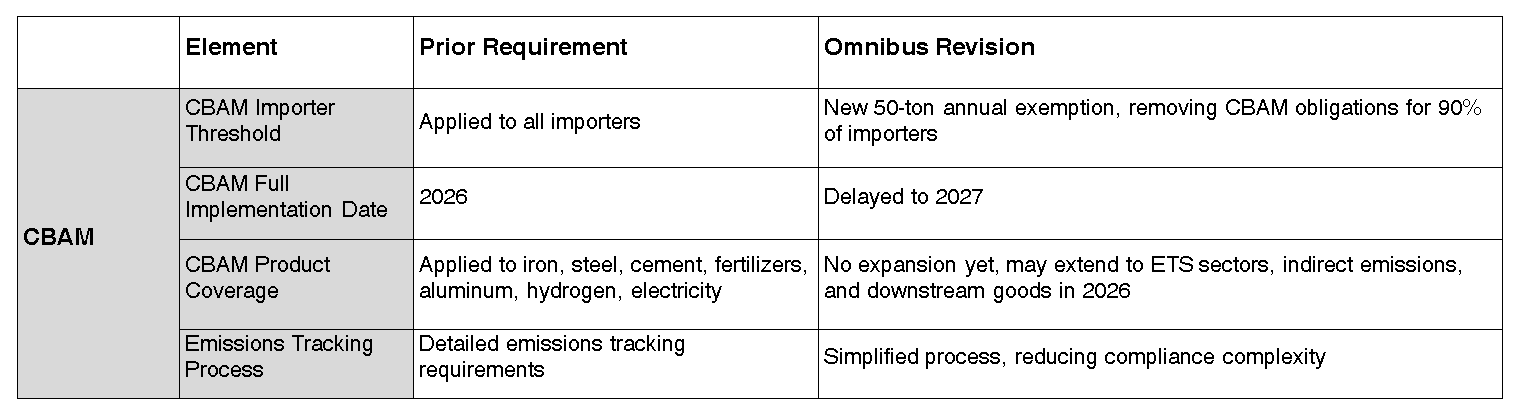

🔎 Breaking Down the Key ESG Regulations

The EU’s sustainability framework is built on three core pillars:

- EU Taxonomy: Defines environmentally sustainable activities and financial disclosures.

- Corporate Sustainability Reporting Directive (CSRD): Expands ESG reporting requirements to a broader range of companies.

- Corporate Sustainability Due Diligence Directive (CSDDD): Imposes stricter human rights and environmental due diligence across supply chains.

The omnibus proposal must be negotiated and approved by two EU institutions, the European Council and the European Parliament, before it can take effect. Until then, the existing Corporate Sustainability Reporting Directive (CSRD) remains in force.

The proposal on reporting deadlines will likely be agreed upon first and implemented by member states before the end of this year. The proposal on substantive changes may take longer to negotiate, which means companies could be uncertain about the precise impact on their reporting for several months.

🔜 What’s Next for ESG Compliance?

The first phase of the Omnibus Legislation will focus on:

- Sustainability reporting simplifications under CSRD.

- Revised due diligence obligations under CSDDD.

- Refinements to the EU Taxonomy framework.

Future packages, expected in Q2 2025, may introduce:

- Extended application timelines for new reporting requirements.

- Adjustments to which companies are affected by ESG regulations.

- Reduced data points and streamlined disclosures to ease compliance pressure.

🇨🇭 What About Switzerland?

The EU’s regulatory decisions have a direct impact on Swiss businesses—especially those working with European clients or operating internationally.

- Swiss Federal Council Consultation (Dec 2024 – Mar 2025): Proposed amendments to the Ordinance on Climate Reporting, aligning with evolving EU requirements.

- Sustainable Corporate Governance Initiative: A Swiss adaptation of CSRD, expected to incorporate changes introduced by the Omnibus Legislation.

For Swiss companies, ESG compliance is not just about legal mandates—it’s increasingly a business necessity for market access and corporate reputation.

💡 What Should Businesses Do Now?

Even with expected reporting simplifications, ESG data management remains a critical priority. Here’s what companies should focus on:

- Implement a structured ESG data collection system—regulations may shift, but the need for robust data won’t disappear.

- Prepare for client-driven ESG demands, even if regulators ease requirements, investors, partners, and procurement teams will still require sustainability disclosures.

- Conduct a double materiality assessment. Though CSRD requirements may evolve, understanding both financial and impact materiality remains essential for risk management and strategic decision-making.

🔗 Stay Informed & Take Action

📌 ESRS Q&A platform: https://ec.europa.eu/commission/presscorner/detail/en/qanda_25_615

📌 Visit our website and book a demo: https://www.esgplaybook.com/

📌 Receive constant updates on regulations and how to reduce risks.

#EUGreenDeal #Sustainability #CSRD #CSDDD #ESG #Compliance #Reporting